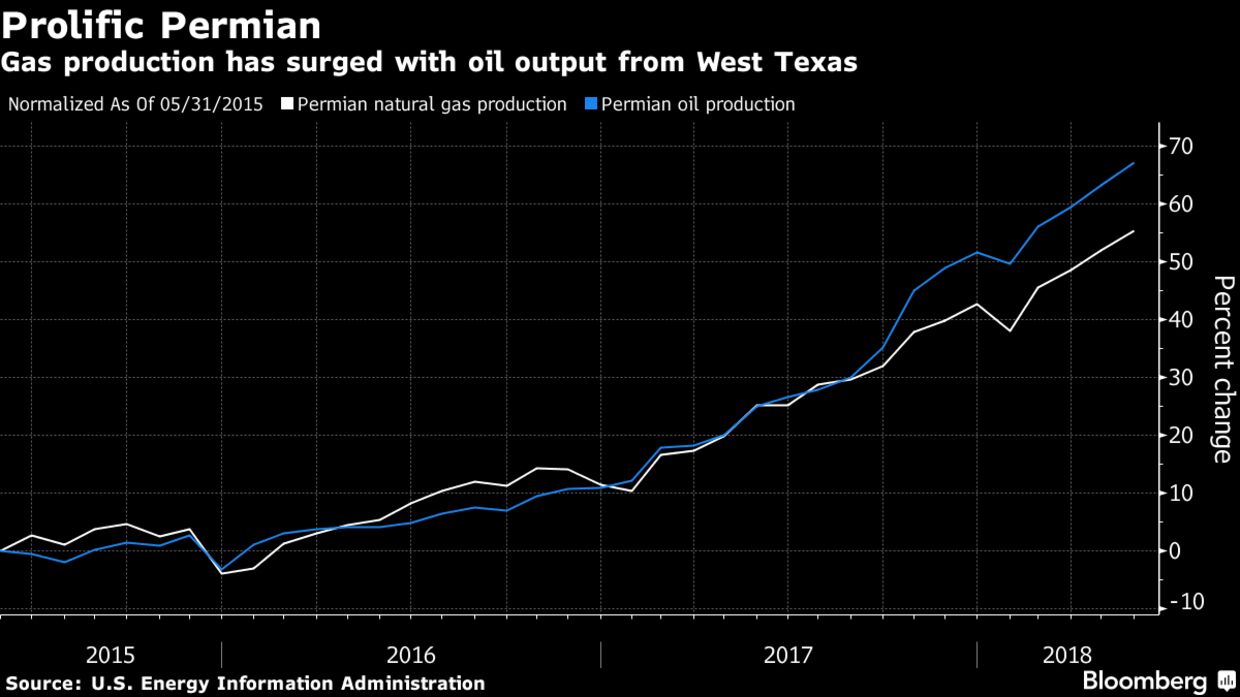

President Donald Trump’s decision to scrap the Iran nuclear deal and restore sanctions was great for oil bulls. But for natural gas drillers in America’s hottest shale play, it could be a disaster in the making. The highest oil prices in more than three years are poised to boost output from areas like West Texas’ Permian Basin, the most prolific U.S. reservoir of the fuel. That would add to the supply of gas that’s produced alongside crude there, making an existing glut even bigger. A surge in oil drilling would deliver another blow to a gas market that’s already America’s worst. The Permian boom has filled pipelines to capacity, trapping gas in the region and making prices there the cheapest of any major U.S. hub. West Texas gas prices could drop to zero on some days, according to Tudor Pickering Holt & Co., forcing explorers to shut production or burn off excess supplies in a process known as flaring. Gas is “getting incredibly cheap again versus oil and refined products,” John Kilduff, founding partner at Again Capital LLC in New York, said by phone. Producers “are just going to try to give it away.”

Gas at West Texas’ Waha hub traded at $2.06 per million British thermal units Tuesday, compared with $2.7161 at the Henry Hub in Louisiana, the benchmark for futures traded on the New York Mercantile Exchange. Waha gas is down 48 percent this year. In the Permian alone, gas flaring is likely to jump as much as five-fold in the next year, Matthew Portillo, managing director of exploration and production research at Tudor Pickering, said by phone. But state regulators typically won’t allow that to continue indefinitely, and limits to flaring could ultimately curtail oil and gas production gains, he said. “Permian growth may actually be limited by the ability to flare gas,” Portillo said. “Basically, the pipes don’t point in the right direction. And the pipes that are available are getting full.”